Noticing the Hellenic crisis allows me to whack a particularly fatuous instance of the perennial debt-bombing siren-sounders -- in this case the paleolithic Brit hysteric Nellie Ferguson, shown above doing an imitation of Tony Soprano doing an imitation of Nosferatu.

Here's Nellie sounding the general all-points alarm:

"It began in Athens. It is spreading to Lisbon and Madrid. But it would be a grave mistake to assume that the sovereign debt crisis that is unfolding will remain confined to the weaker eurozone economies... it is a fiscal crisis of the western world."Imagine! a quarter of the federal budget, interest payments! But, err, to whom will Uncle pay this? Apparently not China:"The Obama administration’s new budget blithely assumes real GDP growth of 3.6 per cent over the next five years, with inflation averaging 1.4 per cent. But with rising real rates, growth might well be lower. Under those circumstances, interest payments could soar as a share of federal revenue – from a tenth to a fifth to a quarter."

"The Chinese have sharply reduced their purchases of Treasuries from around 47 per cent of new issuance in 2006 to 20 per cent in 2008 to an estimated 5 per cent last year."Yikes! At that closing speed, can near-zero great-Han participation in new Uncle issues be far off? And from there, what time till the politburo, by not rolling over their holdings, goes effectively out of the dollar? It might be particularly fast 'cause them damn heathens have bought short, mostly.

Nellie -- always the empire man -- has a nice quote on this very point from no less than Larry S, the Calydonian boar hizseff:

“How long can the world’s biggest borrower remain the world’s biggest power?”There's one problem with hauling that juicy quote in here: Larry means borrowing from foreigners, like China of course; and as much as Nellie might want to place Uncle in an extravagent inescapable squeeze play, Uncle just plum ain't there. Fiscal deficits are a free lunch these days. Why if more and more deficits is what's called for -- why then, far from an inevitable rundown and tag-out, uncle can keep piling up deficit after deficit even as the foreign holders of Uncle's debt contract their holdings as much as they please. If that starts to happen and if it looks to be affecting interest rates and crowding out productive domestic investments... well the fed can just buy up the deficits all by itself.

And furthermore -- if indeed the foreigners stop buying our public debt issues, you can expect the dollar to tumble, and like the 7th cavalry riding to the rescue, a lower dollar will cause our trade deficit to evaporate automatically, and just as automatically reduce the necessary size of any full-employment federal deficits!

We citizen chumps really need to see all this as clearly as possible, 'cause the phonus balonus keeps on gettin pitched right at us. Here's another example from hissy boy Nelly:

"The long-run projections of the Congressional Budget Office suggest that the US will never again run a balanced budget. That’s right, never. "Yeah, okay, Nellie... and so what?

If you want to play this game, here's the key ratio: the long-run ratio of debt to GDP == (deficit /gdp) x (gdp/gdp growth ) => debt growth /gdp growth.

First choose a long-run average rate of deficit as percent of gdp, i.e. the forever-after average fiscal deficit rate. We're at 10-12% or so now, in the depths of a recession; but what is the likely upper bound average deficit forever? That number -- whatever it is -- plus the assumed average rate of gdp growth -- both let us say in current ie nominal not constant dollars -- is anyone's guess, but I'll use a highball set of numbers just to prove my point.

Say we have an 8% average forever deficit to gdp ratio -- the euro zone, that bastion of hard money, seriously disapproves long run average fiscal deficits above 3%. But I'm being a wild man here. And say we have a a modest 5% average forever gdp growth rate -- maybe 2.5% inflation, 2.5% real growth. Then the final ratio of debt to gdp will be as 8 is to 5, right? it's that simple: the debt total will be 1.6 times the current gdp, about twice what it is today here, but very near several Euros and below Japan's.

Since Father Smiff can't understand anything numerical without a graph, here are some pictures for his benefit:

So what is the assumed long interest rate (R) paid on the public debt? Multiply whatever rate you choose by the debt to gdp ratio and you have the debt service steady-state "burden" on the economy. In our example, 8(R)/5. If R is a fairly high-side reasonable 6% we get an 9.6% of gdp burden.

If the federal tax take keeps to its present 19% of gdp, servicing the debt will take about half the tax collections; but with another 8% of gdp each year coming into the federal budget, debt servicing becomes 36% of it. Now yes, Aunt Polly, that's a big number indeed. But it's forever, right? So we have plenty of time to find a unique tax base to extract these service payments from.

Say we effectively tax only the wealthy few for this 8% of GDP. If they own half the wealth and wealth is 4 times GDP, then big deal -- an average 4% wealth tax equivalent on the holders of the top half of our national wealth. Sounds like fun to me!

All this was well understood 65 years ago, at least, and these numbers I've used are not way-off estimates of the possibles for the next 30 years.

And remember, my fellow radical imps, we haven't yet used the fiscal monetary "nuclear option": a transition to all public debt held if necessary by the Fed itself; or another non-nuke WMD, namely Uncle's monetary agents running a faster long-term inflation rate while holding the nominal rate of Fed notes at that same target rate, effectively zeroing out the real rate of riskless return.

Poof! Inflation taxing away the public burden of the debt incubus! Yes, the inflation tax, bane of the goldbugs, that invisible built-in adjuster called the changing cost of "living". Not so much fun, that, as taxing the plutonians, but easily adjusted to, once you real producers of real stuff are made aware of the gig.

Now comes Simon Johnson, respected, credentialed, tenured, and once highly-placed global hi-fi technocrat, suddenly turned rogue lion in the street, who's been roaring "cut the big boys down to size" -- and coming from his desk, that has some purchase, as they say. But on today's topic, where does he stand?

Unfortunately, he's as orthodox a poison peddler as Fred Thompson. No free-lunch deficit guy he... not like your pal Owen here.

"No country can go on issuing... debt without consequence", simple Simon says. Ugh, how banal, what typical high-perch crapola.

"The macro situation remains stable only as long as foreigners buy and hold... government debt.... This is a major economic and national security risk.... Unsustainable debt dynamics can undermine us all."Horsefeathers never were piled any higher than that, and it's all based on the slipped-in assumption that deficits are not sustainable. That assumption, as we've just seen, is pure voodoo hoodoo, once you fling off the sober taken-for-granted unexamined constraints like sacrosanct personal wealth holdings and higher than rock-bottom inflation rates. (You can go down the litany of bourgeois sancta-sanctorum at your leisure.)

Once you can adjust your currency or your inflation rate or your tax targets freely and democrataciously, it's child's play... which brings us back to the playpen du jour, the Hellenic contretemps and the deathly grip of the euro.

One fact spells doom here: Greece has no currency of its own to adjust, so it and Spain and Portugal and my dear Ireland, since they're all similarly shackled, must adjust their price and wage levels instead. Translation: a protracted interval of joblessness, dearth, and misery, so long as the all-powerful "reformed Reichs" to the north of the zone refuse to step up their own rates of price level change.

Just goes to prove... a world without Uncle would find plenty of vicious corporate pricks left on the planet ready able and wildly willing to play sadistic global Procrustes. Andrew Mellon lives and his name is Trichet:

Paul Krugman has been on this beat for a while now:

http://krugman.blogs.nytimes.com/2010/02/11/greek-troubles-are-more-than-fiscal/

http://krugman.blogs.nytimes.com/2010/02/10/riga-mortis/

http://krugman.blogs.nytimes.com/2010/02/07/know-your-deficits/

Comments (10)

What, WHAT is that froufrou over-upholstered parlor that Nellie is sitting in? Tell me that's not where he lives.

And if it is where he lives -- why, WHY is he dressed for a job interview?

Posted by MJS | February 15, 2010 11:19 PM

Posted on February 15, 2010 23:19

http://www.nytimes.com/2010/02/14/business/economy/14view.html

for a sense of the monster within agit prop

this from the bush 43 merlin and crimson catamount

greg mankoo:

"in the long run, a balanced budget is too strict a standard. Because of technological progress, population growth and inflation, the nation’s income and tax base grows over time. "

yes at a likely 5 % rate

"If the government’s debts grow at or below that pace, servicing the debt will not become a major problem."

ie below 5 %

"That means the government can run budget deficits in perpetuity, as long as they are not too large."

too large as in above 5 % right ?

"The troubling feature of Mr. Obama’s budget is that it fails to return the federal government to manageable budget deficits, even as the wars wind down and the economy recovers from the recession."

yikes whats up wid dat ??

greg:

" According to the administration’s own numbers, the budget deficit under the president’s proposed policies will never fall below 3.6 percent of G.D.P. By 2020, the end of the planning horizon, it will be 4.2 percent and rising"

4.2% ?? too large unmamgeable ??

what nominal gdp growth rate are you assuming greg ??

2.5% inflation and zero growth ??

deflation ???

if the nominal economy is growing at 5%

split say

2.5 % inflation

--probably pathologically low ---

and

2.5% real growth

--note not per capita

ie very very likely given our history --

well that assumed rate

shrinks the debt to gdp ratio over time

and stablizes it at 80% of gdp

err where we are now ....

greg dear

is the sky falling yet ???

Posted by op | February 16, 2010 9:48 AM

Posted on February 16, 2010 09:48

greg :

"The administration forecasts economic growth of 3.0 percent from the fourth quarter of 2009 to the fourth quarter of 2010, followed by 4.3 percent the next year."

ya greg nominal growth in a stagnation without inflation makes for a good long range average gdp growth rate number

you yellow toothed

tabby you

btw he rants about or debt approaching 80% of gdp

haven't been there since 1950!!!

i'm moving to ...germany

Posted by op | February 16, 2010 9:53 AM

Posted on February 16, 2010 09:53

on the graphs above

note the rapid and deep decline

of total private debt in japan

over these past two decades

from a peak of nearly 275% of gdp

to under 115% today

talk about sluggish

household and corporate expenditures

paying down that much debt out of income

ie 150% of gdp..

why that'll slow yer "growth" there hoss

Posted by op | February 16, 2010 11:39 AM

Posted on February 16, 2010 11:39

also note

amerika's contraction of private debt

from 30 to 45

around 275% to 70 % or so

twice gdp

of course we used fast deflation

not slow leak stuff like the nipponese are pulling

still one can only quake

at the consequences

if we take pri-debt down

a similar slope over the next 10 years

like japan took over the last 15

err unless uncle runs

some dern bodacious deficits

Posted by op | February 16, 2010 11:47 AM

Posted on February 16, 2010 11:47

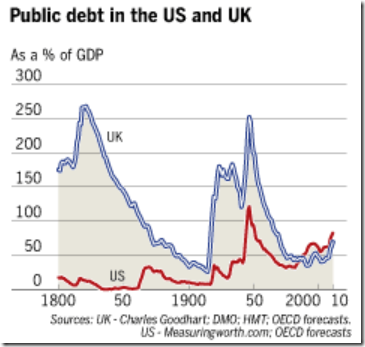

the pub debt to pub debt comparison

between uncle and john bull

shows something like

uncle post hitler

and mr bull post napoleon

time scales are off some

but note the peak of bull's borrowings

plus 250%

and this before the victorian raj

then note the similar high point

after the second rise

starting with the great war and continued to the end of the never so few moment

err and the nice thrifty pay down

that accompanied the decline of britain

from lord of the high seas

to uncle batman's butler

Posted by op | February 16, 2010 11:55 AM

Posted on February 16, 2010 11:55

Cultural questions:

How is Summers like the Calydonian boar?

Why "great-Han"?

Why the 7th Cavalry?

Posted by Save the Oocytes | February 16, 2010 2:36 PM

Posted on February 16, 2010 14:36

Oo

Summers shrewd porcine razor back nature is well documented

he becomes a menace once he's in the seat of power and able to ravage the nations working under belly

for his globalist sponsors and employers

great han

there are a billion of em

and they dominate all of east asia outside

japan

the 7th cavalry ??

i hope that murderous first in first out

uncle lunatic machine

like 101st airborne

needs no gloss

even when used with or without intended irony

as an icon of rescue

like the alpine st bernard with his tiny barrel of rum

Posted by op | February 17, 2010 8:28 AM

Posted on February 17, 2010 08:28

I understood the "mean pig" part; I was just wondering how far the analogy went. Was he sent by a vengeful God? Will people hunt him down and fight over his hid?

In my ignorance I have until now pretty much lumped them all into "the military." I'll have to look this one up, I guess.

Posted by Save the Oocytes | February 17, 2010 11:09 AM

Posted on February 17, 2010 11:09

http://www.voxeu.org/index.php?q=node/4623

that's a royal stooge-ist take

on the inflation method

of pilfering back

from rentiers holding the uncle sam notes

check out senior author

doc sargent

of ratex fame

a real right wing send up he

http://www.lancs.ac.uk/staff/ecagrs/Photo%20Gallery%20of%20Economists_files/sargent.jpg

Posted by op | February 18, 2010 9:58 AM

Posted on February 18, 2010 09:58