Wynne Godley's concept of Stock-Flow Consistency is fairly simple: in a closed system like the global economy, all flows must come from somewhere and end up somewhere. An increase in one stock must be consistent with the net flow into it, and also decreases in other stocks.

Since everybody loves an animation:

This concept can be applied to our earlier sectoral balances equation:

(I-S) + (G-T) + (X-M) = ΔNGDP

You can visualize each of these sectoral flows having a corresponding stock:

(I-S) = -ΔPrivate Stock

(G-T) = -ΔGovernment Stock

(X-M) = -ΔForeign Stock

When a sector saves, it builds up its assets and/or decreases its liabilities. When it dissaves, it reduces its assets and and/or increases its liabilities. This yields a change in the sector's stock, the net position of its Balance Sheet (Assets vs. Liabilities).

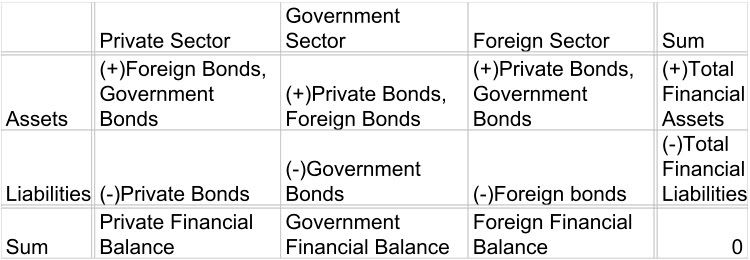

As you can probably imagine, keeping track of these stocks and flows between more than two sectors is a bit of a difficult task. In order to summarize the state of a large system, and the interdependency of the various sectors, Godley uses matrices. Shown below is a simple matrix that, for simplicity's sake, only considers financial assets and liabilities to simply be money borrowed or lent in the form of bonds:

Say the government spends $50 billion, and takes in $100 billion in taxes:

(G-T) = -ΔGovernment Stock

($50B - $100B) = -ΔGovernment Stock

-$50B = -ΔGovernment Stock

$50B = ΔGovernment Stock

The government's stock would increase by $50 billion. If the government is already in a net debtor position, the net debt would decrease by $50 billion. In order to satisfy Stock-Flow Consistency, the other sectors would have to borrow $50 billion from the government, or the government would have to build up its cash holdings and other sectors decrease their cash holdings (not included in the above matrix). These cash holdings, or money stocks, act as a buffer within the system, allowing the economy to run smoothly.

What happens when one sector can't find another sector to lend to, or to borrow from? The amount that is not recycled through inter-sectoral lending or borrowing is instead added to a sector's buffer stock of money, or effectively destroyed by paying down a debt to a commercial bank, or created by taking a new loan out from a commercial bank, showing up in a change in NGDP.

This is about as far as we can go with this simple model. In the next post I'm going to start disaggregating the private sector and introducing a banking system that actually creates dollars. I realize that this post is a bit dry, but I just wanted to introduce some of the basic methods and concepts used in Godley's analysis before delving into the more interesting stuff.

Comments (10)

Is there a way to make the buffering more effective?

Posted by Al Schumann | August 18, 2010 2:58 PM

Posted on August 18, 2010 14:58

Well, it may seem kind of counter-intuitive but in an ideal world you would probably want to eliminate them altogether. The buffers are kind of a (small) necessary evil

The solution would be something like a completely digital currency based on a combined credit/debit card.

Roughly speaking, it would work something like this:

You would get paid say 5% on all positive balances, and pay 5% on all negative balances. Your positive balances would automatically be lent out to other people. Your negative balances are borrowed from other people. Your limit would be determined as a ratio to your income. The system could be intermediated by a government run banking system, where the interest rate is set so as to equate saving and borrowing, or increase borrowing beyond saving if you want to increase the money supply. In periods of extremely depressed demand where no one wants to borrow, the government could simply credit money to everybody's accounts with the stroke of a key.

The idea is to avoid having people save without lending, as that type of saving reduces demand in the economy. By having the money available to be lent out to someone else, rather than being stuffed under a mattress, you avoid the decline in aggregate demand. FDIC was a step towards establishing the type of system I sketched out above, and put an end to the old kind of banking crises.

This kind of system was proposed a long time ago, but the conversion would be difficult. For one thing, the effect on the black/grey markets could be devastating. People also like the anonymity of cash and might have some privacy issues with such a system.

Posted by FB | August 18, 2010 3:32 PM

Posted on August 18, 2010 15:32

A generous response, thanks.

Would demurrage help with the excess savings? Maybe combined with some kind of sweetener for allocating it to socially useful projects? And, if the question is apposite, could that be done in a way that doesn't trigger privacy issues?

Your last paragraph, by the way, opens a can of worms that I find fascinating. Ideally, I'd prefer an economy that was entirely grey and black, but perhaps that's a topic for another day.

Posted by Al Schumann | August 18, 2010 3:45 PM

Posted on August 18, 2010 15:45

"Would demurrage help with the excess savings? "

I guess that would mean not only reducing the rate to 0% (giving no incentive to save, and maximum incentive to borrow), but actually making the rate negative (penalizing people for saving and paying people to borrow, say lending them 100 and only asking for 95 back in a years time).

I think that might work, but people would probably be pissed. It would probably be pretty difficult to convince people to let the government destroy their hard earned savings.

I think that the best way for it to be allocated into beneficial projects is for the government to borrow it on its own account and spend it. The government would also have its own account in the system and act as borrower of last resort, in the classic Keynesian fashion.

As far as the black market issue goes, I like to think that going to a digital currency could have the positive effect of forcing some sanity into the drug, gambling and prostitution laws, while at the same time curbing tax evasion, fraud and corruption. I'm sure that people would still find ways around it though.

Posted by FB | August 18, 2010 4:10 PM

Posted on August 18, 2010 16:10

Yeah, I would bet they'd be pissed off, come to think. I mentioned it because of a comment you made regarding pensions plan, that it would be better to make social security bigger and pay out more, rather than try to whack-a-mole with the misfeasance and malfeasance plaguing the pension funds. Savings wouldn't be all that important if there were a guaranteed backstop, like a social security payment sufficient to live on. That would be made much easier by a digital currency. Although I can just imagine the amount of stress it would cause when glitches crept in.

Posted by Al Schumann | August 18, 2010 4:39 PM

Posted on August 18, 2010 16:39

under gosplan II

you retain cash but run a rate of inflation

the digital system has that nice advantage it's indexed

household savings is an anachronism...already

---

returning to reality

the buffers are crucial and in and off themselves socially costless

part off the cloud of digits suspended over the exchange system suspended over

the production system

----

if we had a central clearing house for all this and a set of perfectly kept books

uncle full employment

could keep elements of the underlying production system

cooking along indirectly by playing tthe balance sheets like a vast credit/cash

pipe organ

since there is not visible meta structure

meta agency over the hi fi digital cloud

we get weather fair and foul spontaneously generated

i know fb will move on to internal credit/money

versus outside uncle money

the inside money is the source of various credit cyclones typhoons droughts

floods spouts and other such

greatly more then "frictional" forcings

all of which task and twist

the morphings of the production system below

Posted by op | August 19, 2010 10:16 PM

Posted on August 19, 2010 22:16

"credit and insurance are a social unity in contradiction with itself "

some one said that somewhere

fdic is indeed the baby shape

of all things progressive

one has now a payment grid

forget households for a moment

and just consider firms or private corporations or what ever

all business outfits owing each other for

various items

right now this system of interlocking payables and receivables is limited largely

by itself

in the form of bank lines of credit

consider a payment system that is insured

universally like fdic insures deposits

uncle as the pope of credit

Posted by op | August 19, 2010 10:25 PM

Posted on August 19, 2010 22:25

flow is everything here

the system can never rest

the circle of value

drives the circle of production

flows as heros and villains

but stocks get to play

queen maker

and

dunce maker

Posted by op | August 20, 2010 6:26 AM

Posted on August 20, 2010 06:26

"in a closed system like the global economy"

the only economy IS the global economy

in a private profiteering age

of multi national

every where they wanna be

limited liability

exploitation devices

a planet

where its not just all about

trans border raiding and looting

but about building and maintaining

earth wide networks of

privately owned and operated

corporationally constituted

market hegemons

what of the bordered regions ??

they tell the struggle story

through limits to entrance and exit

that both contain and immpell

and expell these basic units

of the ongoing

global corporate metastases

consequence:

in the policy sphere its all about

locality

all about "national liberation "

usually at peak intensity

inside problematic

teetering on the edge of evolving

from proto hot spot zones

to main frame hot spot zones

-------------------

Posted by op | August 20, 2010 6:59 AM

Posted on August 20, 2010 06:59

fb is ful of hope

because he has revolutionary insight

that ought to be

the holy grail here

un supported

patch work " minimum programs "

bring only dispare

the delusions

of reform must fall away first

before a revolutionary insight

and

the restoration of limitless possibility

perhaps that is what oxy and flug nutz

and their bosky ilk might gain

if only

they tried thinking about these

fairly simple paradigms

a break thru in conceptualization

a reborn delight in the mundane

a revisioning full of possibility

not sardonic doldrums

pink acedia is

a cardinal sin among cardinal sins

Posted by op | August 20, 2010 7:10 AM

Posted on August 20, 2010 07:10