I have an exceedingly low regard for Aussienomics, and I hope you all do

too!

I have an exceedingly low regard for Aussienomics, and I hope you all do

too!

Of course in my account book the legendary Marx sublator and mechanical debt nut, Stevie Wonder of Keentown, leads all comers from the little down-under. But more conformitory post-Keynesian types -- like Johnny Q, the people's credit quigsling -- are not too far behind.

Speaking of dear Johnny, here's a recent Quigogram from the outback of the collective white male brain:

"The US needs more stimulus now!...combined with a substantial increase in tax revenue in the long term."That second bit there is the stinger: pure clown poison, in fact worthy of our second most favorite porcine econ-con, pigsley pigsty Delong of the Rubinomical memorial ICU . A pure batch of campus horse feathers, as sez this link of the day to the clever Slacker Ace Mason:

"Here's John Quiggin at Crooked Timber writing that the US needs "a substantial increase in tax revenue in the long term" and backing it up with the claim, "I assume [the optimal debt-GDP ratio is] finite, which would not be the case under plausible scenarios with no new revenue and maintenance of current discretionary expenditure relative to national income." ...Given the historic pattern where GDP growth is above the interest rate, this statement is simply false."Splendid! And here's why, sez the analytic Mr SA, in nothing less than formula form:

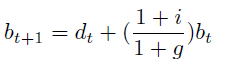

Let b be the government debt and d the primary deficit (i.e. the deficit exclusive of interest payments), both as shares of GDP. Let i be the after-tax interest rate on government borrowing and g the growth rate of GDP (both real or both nominal, it doesn't matter). Then we can rewrite the paragraph above as:Fellow congregants: for us citizens of the liberty republic, 'tis case three that rules, 'cause here in America g over time exceeds i and can always exceed i, thanks to the possibilities of any decent credit-based production system and a hearty people's central bank

We can rearrange this to see how the debt changes from one period to the next:

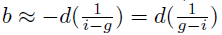

Now, what happens if a given primary deficit is maintained for a long time? Does the debt-GDP ratio converge to some stable level? We can answer this question by setting the left-hand side of the above equation to zero. That gives us:

What does this mean? There are three cases to consider. If the rate of GDP growth is equal to the interest on government debt net of taxes, then the only stable primary balance is zero; any level of primary deficit leads to the debt-GDP rate rising without limit as long as its maintained. (And similarly, any level of primary surpluses leads to the government eventually paying off its debt accumulating a positive net asset position that grows without limit.) If g > i, then for any level of primary deficit, there is a corresponding stable level of debt; in this sense, there is no such thing as an "unsustainable" deficit. On the other hand, if g < i, then -- assuming debt is positive -- a constant debt requires a primary surplus."

Yup, we don't need no stinking tax rate increases or friendly loopholes closed (like the mortgage deduction or the earned income tax credit) or new tax bases found, like on existing entitlement benefits -- err, which is not to say that (f'rinstance) a lifetime income tax, "the stealth way to tax wealth away", wouldn't be a grand byway to service Uncle's debt, eh?

Comments (6)

Augh... formulas.

Economists are a breed unto themselves, and so is their reality.

Posted by Drunk Pundit | June 13, 2011 11:23 PM

Posted on June 13, 2011 23:23

These are the good economists, don't worry. Or do, actually. They are a breed onto themselves. But this time the good ones are making the case that a big, pervasive credit system of production can sail the seas easily—unless people deliberately drill holes in the hull.

Posted by Al Schumann | June 14, 2011 5:46 AM

Posted on June 14, 2011 05:46

Ha. I'll take your word for it Al.

I'm just naturally skeptical that any formula can adequately describe economic activity in the real world simply because humans, and the events that affect them, are so unpredictable.

Posted by Drunk Pundit | June 14, 2011 12:41 PM

Posted on June 14, 2011 12:41

The honest

con artistseconomists concede that their models and formulas are approximations applied to deliberately circumscribed contexts.Posted by Al Schumann | June 14, 2011 1:10 PM

Posted on June 14, 2011 13:10

"Econometricians, they're ever so pious.

Are they doing real science,

or confirming their bias?"

--- Hip Hoppin' Hayek

http://www.youtube.com/watch?v=GTQnarzmTOc

Posted by chomskyzinn | June 14, 2011 1:34 PM

Posted on June 14, 2011 13:34

http://www.levyinstitute.org/pubs/pn_11_02.pdf

jaimie chimes in

apropos the i/g ratio assumed in the cbo scare

projections of "unsustainable deficits "

"The significant conclusion is that there is a devil in the interest rate assumption"

yup the sneaky trick is the 5/5 ratio

nominal i/g

(2% inflation rate )

yup its in the arithmetic

that ratio held to like its the

straightest course home

requires a zero long run

primary deficit/surplus

ie

growth funds the interest payments

on the debt but can't fund a spending induced deficit

total deficit years minus total surplus years must = zero !!!!

and it's a knifes edge

if either we run a steady net deficit

(ie over the cycle cycle after cycle )

or a net surplus

the system marches off to the horizon

either towards as a disappearing

moose into mouse

shrinking toward jacksonian paradise

a pay off able federal debt

or a ever increasing goliath debt

rising up to make rentiers of us all

err rentiers of coolies

jamie nicely notices two facts

we have run a negative real rate of interest since the japs surrendered to uncle sam

in tokyo bay

the first time slab

pre volckerdammerung

was where and when

all the big negative years lived

reagan bush clinton the golden time for

policy induced passive bond margins

has been robustly positive

again the inflation flame is contained not unleashed as weapon of policy

jaimie is not a colander cadet i guess eh

surprised ??

i'm not

no body but prometheus the titan

dares dream of inflation as man's greatest macro weapon of choice

Posted by Anonymous | June 17, 2011 9:22 AM

Posted on June 17, 2011 09:22