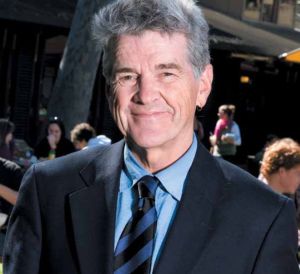

Who is this ear-ringed Aussie? It's my second-favorite Billy Mitchell. Like my top favorite Billy Mitchell, shown below --

... this Billy Mitchell also lords it over an obscure subculture that has recently caught the attention of the mainstream.

A few months back I noticed that many of the better commenters had disappeared from my favorite economics blogs. Why did my stomping grounds suddenly feel like Studio 54 circa 1985?

As it turns out, everyone was on to the new new thing: Modern Monetary Theory, or MMT for short. MMT is a neo-chartalist economic theory promoted by Bill Mitchell and a few other eccentric characters. The main insight of MMT is that money is a creature of the state and under a fiat, floating exchange rate currency regime, a sovereign government has no nominal spending constraint.

What does this mean in English? Any country that prints its own currency and borrows in its own currency can never go bankrupt against its will. It can always print more currency to pay off its debts. A second key aspect of MMT is an emphasis on full employment as the appropriate goal for monetary and fiscal policy.

Who are its enemies? The deficit terrorists like Pete Peterson, the IMF, the EU leadership and the rest of the neo-liberal establishment.

Sounds good, right? As much as I am with Bill & co. in spirit, I do find his underlying economic arguments a bit off -- but that's a subject for another post. Nonetheless, I have to applaud the success he and his allies have had in popularizing a strong anti-austerity position, despite the prevailing deficit hysteria.

Just a few weeks ago I turned on BNN, my beloved closet-leftist Canadian business network, and saw one of his allies, Marshall Auerback, eloquently bashing the deficit hawks. Music to my ears!

The next step in the MMTers' publicity campaign is being organized by some of our friends over at Corrente: a teach-in and shadow conference taking place on April 28th in Mordor-on-Potomac. The idea is to provide a counter-narrative to Pete Peterson's deficit terrorist conference that is happening at the same time. I encourage everyone to do what they can to help out with this laudable initiative.

Not to prod, but in particular I think they could use a bit of high quality agitprop, *cough* Fluggenock *cough*.

Comments (35)

m baggers

Posted by op | April 12, 2010 12:35 PM

Posted on April 12, 2010 12:35

A question asked from partial ignorance: how does this theory apply in some "lawless" region where modern economic conditions do not obtain?

Posted by Jack Crow | April 12, 2010 12:40 PM

Posted on April 12, 2010 12:40

"I propose that Firedog Lake, The Huffington Post, New Deal 2.0, and The American Prospect jointly sponsor and provide financial backing for this Conference"

snooze control

Posted by op | April 12, 2010 12:40 PM

Posted on April 12, 2010 12:40

Econ-blog commenters... so fickle.

Posted by Save the Oocytes | April 12, 2010 12:50 PM

Posted on April 12, 2010 12:50

"how does this theory apply in some "lawless" region where modern economic conditions do not obtain"

what ya got in mind ???

"lawless"-ness in one country ???

------

"I do find his underlying economic arguments a bit off -- but that's a subject for another post"

why wait

the thesis:

"Any country that prints its own currency and borrows in its own currency can never go bankrupt against its will. It can always print more currency to pay off its debts"

look the hole in this gimmick is

the price level itself

it will run away from the monetizing process

till the currency de montizes itself

you have to put a price level control mechanism in place

a map

or you get zimbowanga

as to full employment as a target of macro policy

hardly a neo-charlalist brand monopoly

i strongly recomment laying off this hooch

it succeeds in vindicating the neolib terrorism

once the notion of a weimar run away surfaces

never to be put back into its bottle by rational argument alone

no

you have to offer a price level mangement solution first

and demo it on a runaway sector

like health costs

or a post deval import sunami

as to full employment

ala vickrey

hyper employment

ivory soap pure employment

its like the deval issue itself

lets get to the taboo line

the 4-5% un rate

the nairu high water line

and get there as fast as hell

once neo lib full employment

is reached

and rapid job growth is still in prospect

and success has put popular momentum

on the side of progress

then restructure the system

Posted by op | April 12, 2010 12:55 PM

Posted on April 12, 2010 12:55

Owen, I don't speak/read your version of Poetic Interference.

Yes, an inferior soul in your very midst...

...so I guess I'm just asking how this theory explains exchanges between people in places where the infrastructure doesn't exist.

Posted by Jack Crow | April 12, 2010 1:00 PM

Posted on April 12, 2010 13:00

Jack, I think the short answer is no.

The contention of the MMTers is that deficit hawkery is largely an anachronistic left-over from the gold-standard/bretton woods era. They argue that the game changed when Nixon closed the gold window, but that economists are still arguing as if that never happened. According to the MMTers we are not taking advantage of the opportunities of a modern system where the government prints its own currency that is not backed by gold.

Posted by FB | April 12, 2010 1:14 PM

Posted on April 12, 2010 13:14

op,

Hold your fire!

I put in that caveat because I knew that you would respond exactly as you did. Believe me, I shared all of your misgivings, but please trust me that there is actually a bit more here than meets the eye. Even Billy is aware of real constraints, but he is deliberately simplifying to make the simple points (that are available in some conventional economics) to the masses. If it takes the label MMT and a bit of simplification for people to understand these concepts, then I have no problem with that.

Don't cut down the popular front just yet, because I assure that there is stronger stuff for the vanguard. The New Classicals were never in so quick to attack the Austrians, eh?

Posted by FB | April 12, 2010 1:23 PM

Posted on April 12, 2010 13:23

FB,

I understand the stated conflict between hawks and the MMTs (and I read up on it first, following the Corrente discussion).

I'm really just trying to understand how the theory applies everywhere else, where massive superstructures don't exist.

Also, upon reflection, how does the theory work when used as a template to describe relations between nations which could pull it off (the US) and regions from which those nations pull their resources (say, Indonesia, or Nigeria)?

Posted by Jack Crow | April 12, 2010 1:29 PM

Posted on April 12, 2010 13:29

all of which

is NOT to say

education...slow-motion agit prop

needs to commense immediately

but not by means of chartalist perpetual motion machinary

though to bother attacking

its entirely innocent and well intended

true believers

is a folly

even if only viewed

as a waste of energy

like georgist ground rent folks

one can bloc

with these mitchell

limitless fiscality folks

without

spreading their gibber ourselves

Posted by op | April 12, 2010 1:39 PM

Posted on April 12, 2010 13:39

as to fighting the deficit terrorists

the broadest front needs to be formed

and that is one that takes the fiscal horizon step by step

right now we need job recovery

and if it comes to it

we need to defeat SSI benefit mangling

that means joining forces

with the likes of

those sour tasting

hair balls

at amerikan prospect

Posted by op | April 12, 2010 1:45 PM

Posted on April 12, 2010 13:45

Okay, Owen, that's your assignment.

Posted by MJS | April 12, 2010 2:07 PM

Posted on April 12, 2010 14:07

"the broadest front needs to be formed

and that is one that takes the fiscal horizon step by step

right now we need job recovery"

uh, and your suggestion is???

Forgive me for being a bit skeptical of your preferred front-building strategy of bashing the commenters who stumble into Thoma's middle-brow pwog salon over the head with your brand of obscurantist econo-poetry.

The fact of the matter is that they have had more success with their strategy in about 4 months than you have had in 4 years. I really don't see where you get off on looking down your nose at them.

And again - there is more to this gang than limitless fiscality, although I admit that Billy in particular does play up that angle more than I would like.

Posted by FB | April 12, 2010 2:09 PM

Posted on April 12, 2010 14:09

jack

the interesting part is just how closed must a national econo0my be to pull off a rapid rise in sovereign debt

before that debt flies to pieces

on the debt markets

we have legions of evidence here

the emerging economies can't pull this off without inducing de facto autarky

the collapse of the "local" currency forex

will lead to massive exportation unless

controls are placed on them

export controls ??

imagine how well they'll work

if you'd end up exporting

food commodities

then urban scarcity riots emerge

etc

frankly i think body checking the word bankrupcy is sufficient here

and that indeed suggests one notice

the limitless dollar mine

but to go beyond that

to suggest the fed can fund anything uncle wants to pay for

well...

at any rate

yes since uncle funds himself

with dollar bonds

bonds the fed can buy for free

and ....

AND

so long as the economy is running in heavy slack mode like now

and import deficits are officially neglected

as they were thru the bush II dispensation

then appearances

might seem to support

the chartalist paradigm

the end of bretton woods was not

the end of credit rationing

despite the dollars liberation from gold

--and not only because real wage control

requires nominal wage control---

when operating near the capacity limit

corporate free range price increasing

-- on non trade-ables--

tends to accelerate

so they needs to be controled

think of it this way

you ration credit

so you don't have to ration

either prices or products

but if you had a mechanism that efficiently

rationed price increases ...

enter map and mark up cap and trade

since these "real" systemic solutions are fairly easy to grasp

i see no reason to teach this charalist bs

simply to in the future unteach it

just ignore it until some one asks you to comment on it

and when you do and u've demolished it

make sure you tell folks not to waste time trying to convert them to the true gospel

they are on our side and have no chartalist reason to part company with us

unless they oppose

forex and price setting

reform

Posted by op | April 12, 2010 2:15 PM

Posted on April 12, 2010 14:15

looking down my nose is impossible

it has a celtic ski jump snub to it

becare to not confuse

one souls personal methods

with methods even that soul

might find suitable to an organization

"front building " strateeeegery

is org work

and i am in particular suggesting a kindly

organizational indulgence toward chartalists

by any pwog organization

that recognizes the job market slump as priority one here

we need to double down on our fiscal deficit

uncle won't of course

and its not because the defict terorists core thinks we'll go bankrupt

but because ewe'd destabilize "the corporate " stablization of world markets

ignorance of ultimate consequences

obviously solves nothing

even if chartalist illusions

carry the fight forward right now

no one how knows better should encourage

anyone else to study their patent pending fiscal perpetual motion machine

crow has it right

we only need to look to the periphery

to see chartalism proven wrong

Posted by op | April 12, 2010 2:26 PM

Posted on April 12, 2010 14:26

"more success with their strategy in about 4 months"

WTF are you talking about, FB?

Meanwhile, what does "can never go broke" mean? Going asymptotically almost-broke isn't excluded, is it?

The economy is imposed on and derives from ecological and human work. Money is a way of counting and allocating these real, physical things. The gold standard was just a wrapper roughly symbolizing this core fact.

Endlessly printing money cannot possibly be the answer to all our problems. Hell, if it were, don't you think our masters would have struck upon it by now?

Posted by Michael Dawson | April 12, 2010 2:32 PM

Posted on April 12, 2010 14:32

"there is more to this gang than limitless fiscality"

what more ???

other progressive targets

what differetiates them is their "science"

and if the foundation of their "science"

is unsound

sharing our objects like hyper full employment

is incidental albeit a basis for solidarity

---

bashing with the old chin rest is perfectly splendid one on one technique

as a member of and organization

i'd put my chin rest back up under my chin

and leave it there till ordered

by the polit bureau

to use it on

the class enemy

Posted by op | April 12, 2010 2:32 PM

Posted on April 12, 2010 14:32

OK, I looked at this guy. Turns out his argument is noble, but, as with all in the long line who imagine you can technocrat-talk your way past power, it amounts to the commonplace observation that democratic states not beholden to capitalists could do without borrowing to finance their deficits, provided they keep a realistic detailed respect for the availability of resources.

In other words, socialism could work, if done properly.

Ain't nobody going to get to try to prove that by refining monetary theory.

Economics follows the powers-that-be. Not vice versa.

Posted by Michael Dawson | April 12, 2010 2:42 PM

Posted on April 12, 2010 14:42

sigh...

Ok, I guess I should start working on that other post. It's time to bring op into the 'inner circle'.

"forex and price setting

reform "

Some of them actually developed almost exactly the same theories that you seem to regard as your own original insights (yellow-flag America, the forex tilts, the barely-averted surplus-induced crash of the early noughties etc.) long before you ever did, and did a much better job of it. Good enough for the chief economist at Goldman Sachs, in fact.

"Hell, if it were, don't you think our masters would have struck upon it by now?"

See the last sentence, above.

Posted by FB | April 12, 2010 2:42 PM

Posted on April 12, 2010 14:42

it's quite delightful to read about

the break down of monetary systems

where the realization of the states

"limitless money mine " ends up destroyiong the underlying credit system

that makes it possible

Posted by op | April 12, 2010 2:55 PM

Posted on April 12, 2010 14:55

op,

How many times do I have to repeat that these guys are aware of the concept of real constraints? I realize that Billy plays fast and loose with this stuff, and does seem to willfully ignore inflation issues (a charge that he has admitted IIRC), but they are not crude Zimbabwists

Posted by FB | April 12, 2010 3:06 PM

Posted on April 12, 2010 15:06

but by all means, continue to harp on about the need for vigilant fire-safety protocols in the midst of a biblical flood. That's obviously THE most important issue right now.

Posted by FB | April 12, 2010 3:11 PM

Posted on April 12, 2010 15:11

fb

we aren't disagreeing here are we ??

i hardly expect u to defend these folks

nor condemn them

i don't have anything against em

as u point out

in a time of deflation like now

a theory that only has problems with inflation

are perfectly harmless

and if the embolden some folks to attack the deficit hawks head on

more power to em

Posted by op | April 12, 2010 3:51 PM

Posted on April 12, 2010 15:51

Yes, that's why I said to trust me on this one.

Obviously I saw the same problems that you do. The thing is that it led me on a path to something a lot better (or at least it seems that way to me). MMT might provide a similar intro for many other people, like Rolling Stones as a intro to Muddy Waters or something like that.

I've got something stronger on the way that is in need of some exacting peer review. Unload on that one.

Posted by FB | April 12, 2010 4:01 PM

Posted on April 12, 2010 16:01

fire away fb

onward to

the inner circle

btw

what is this all about ???

"the barely-averted surplus-induced crash

of the early noughties "

Posted by op | April 12, 2010 5:38 PM

Posted on April 12, 2010 17:38

Sorry, that was incredibly badly worded.

All I'm referring to there is the idea that if it weren't for Greenspan and Bush opening the monetary and fiscal floodgates, we would have had the GFC in the early 2000s, and also that the Rubin policies led to that situation.

Reflecting on it a bit more calmly now, I'm not sure that you would really consider it to be one of your unique motifs. Sorry if I misrepresented you there in the heat of the moment.

Posted by FB | April 12, 2010 5:55 PM

Posted on April 12, 2010 17:55

md

gets to a higher point

what policy is compatible with the system

anything that isn't anything that leads out of the system

will be rejected

and don't think u can smuggle

a system busting "reform"

past the PTBs

u can't

btw fb

what exactly is it

about explaining

"the why"

of the present

de facto

oecd

yellow flag policy

which errr...they share with me

and i suspect many others

including ken rogoff and larry summers

oh ya

how could they have talked about it

years ago when its only two years old ???

show me the passages

they certainly must run an independent course

from their limitless dollar mine eureka

how they derive the forex tilt from

their liberated fiscal system theory

must be quite an inversion

unless it has an independent basis

in a theory of the MNCs

and how the MNCs dictate trade policy

and forex policy

over riding any chimerical "national interests"

with very concrete MNC interests

if they got em

show me their model work

Posted by op | April 12, 2010 6:00 PM

Posted on April 12, 2010 18:00

It's coming - everything single thing you have asked for there, full models, on-the-record predictions going back to 1999, etc.. It may not be perfect, but it all exists. I got somewhere to be right now, but I will have a finished post sent to MJS tonight.

Posted by FB | April 12, 2010 6:07 PM

Posted on April 12, 2010 18:07

and yes, it is somewhat of an independent course. I think you will be pleasantly surprised. At the very least it will make a nice punching bag.

Posted by FB | April 12, 2010 6:09 PM

Posted on April 12, 2010 18:09

All theory aside, it seems to me that what the Fed Govt will do if any of its larger debts to other nations' creditors are called due is very consistent with this Pointy-Head Theory Not Approved by Certain Economists.

I'd bet the Fed Govt will say, "oh, we owe you X dollars? I'm sorry, but we now consider that debt irrelevant."

As a practical matter the Fed Govt regularly ignores deficits and prints new money.

Who cares whether theorists say it's not wise. It's done. And probably will keep being done.

Y'all sound like sports fans arguing over statistics in lieu of having real game to watch.

Posted by CF Oxtrot | April 14, 2010 1:52 PM

Posted on April 14, 2010 13:52

Ox,

I would maybe word it a little differently, but you definitely have the right idea: foreign creditors have no leverage really, and the US is holding the trump card. I think that even your loathed Krugman has made the same point.

"Y'all sound like sports fans arguing over statistics in lieu of having real game to watch."

I'd use a slightly different sports analogy:

Me and OP as coaches of an inner city basketball team who can't win or even fill their bleachers. The school is about to cancel the whole program, and we are facing a prep school 5x champion team who have had their own personal trainers since age 8 and have hired Phil Jackson to coach.

Suddenly the Harlem Globetrotters show up and offer to join the team. I'm like "sweet! We could use the help, and I'll take anything I can get at this point; anything that fills the stands and gives us a chance"

Whereas OP is like "No way Jose. I've seen these guys play: double dribbling, traveling, sliding around on their knees, taking risky skyhooks, bounce passes off of the defenders heads etc. The fundamentals are not sound, at this would never fly in the NBA. No one will take us seriously"

Me: "Who gives a shit. That's all besides the point right now, and you know it"

Posted by FB | April 14, 2010 4:53 PM

Posted on April 14, 2010 16:53

FB: your sports analogy is more accurate for sure! I'm an ignoramus on economics; I only know what I witness, and not the theoretical whys and hows. It just makes sense to me that if currency is fiat-based, then it can be printed whenever the mood strikes, and the borrowing of such currency from abroad can be disregarded whenever the mood strikes.

This is what always has confused me about money. Isn't it good as a moderator of exchange only to the extent it's treated consistently?

It strikes me a bit like this: I have chickens on my farm. My neighbor the dentist says he will fix my gamey tooth for 3 dozen eggs. I drain the eggs of their contents and replace the contents with water, and give him 3 dozen apparent eggs that are little more than hardshell water balloons.

Have I really given him 3 dozen eggs?

Posted by CF Oxtrot | April 14, 2010 5:46 PM

Posted on April 14, 2010 17:46

The way that I would approach that example is to say that an egg farmer could always suck out a tiny bit of each egg's contents, replace it with water, cook himself a free breakfast everyday, and no one would be the wiser.

What I mean by "real constraints" (limits on watering down your eggs) and why Owen brings up inflation, is that if you do this too much people will start noticing that your eggs are 1/4 water, and start demanding 4 eggs to fix your tooth (inflation). If you take it to an extreme, like Zimbabwe did, you get eggs that are all water that nobody wants (hyperinflation).

My point is that right now we are in a disinflationary environment (there is a brutal shortage of eggs) and our eggs are only like 5% adulterated, so nobody is about to start complaining about a watery egg here and there if we up that to 10%.

This example is a little more like Bretton Woods than a fully fiat regime, but I think it gets the basic point across.

Posted by FB | April 14, 2010 6:27 PM

Posted on April 14, 2010 18:27

whoops, that should be "start demanding 4 dozen eggs to fix your tooth, instead of 3 dozen"

Posted by FB | April 14, 2010 6:32 PM

Posted on April 14, 2010 18:32

The way that I would approach that example is to say that an egg farmer could always suck out a tiny bit of each egg's contents, replace it with water, cook himself a free breakfast everyday, and no one would be the wiser.

Ahhh, that's excellent! I'm still laughing!

Posted by CF Oxtrot | April 14, 2010 9:59 PM

Posted on April 14, 2010 21:59