Could this man, Gentle Ben of Temple Fed, be the future Jimmy Stewart of homespun people's biz finance? It's on the order of the day, and the grey lady has a question in her mouth about it all: should the fed emerge from the current credit crisis as a hands-on outfit operating exclusively for the collective benefit of that noblest of all noble abstractions -- "the people"?

[T]he Fed... stepped in to fill the lending vacuum left by banks and Wall Street firms [and now] officials have been dragged into murky battles over the creditworthiness of narrow-bore industries like motor homes, rental cars, snowmobiles, recreational boats and farm equipment."And what's so wrong with that?

"A growing number of economists worry that the Fed’s new role poses risks to taxpayers and to the Fed itself -- If the Fed cannot extract itself quickly, they warn, the crucial task of allocating credit will become more political and less subject to..."Hold that fart --

"... rigorous economic analysis."Because? For one thing, such micro lending is "far removed from the central bank’s expertise."

Get it? Credentialed meritoids, awake!

As if that alone were not enough to set the entire professional class of the upper West Side into motion, the grey lady goes on to mouthpiece mode: "Fed officials acknowledge" that doing stuff like lending to real economy credit sectors directly could

"undermine the Fed’s political independence and credibility as an institution..."Ready the ass-cannon again --

"... that operates above the fray.""Political independence" from whom? One can only imagine -- the congress, and in particular the House, that pool of fetid stupors. Yeah, sure, the House created the Fed in the first place, but this "independence" is supposedly crucial. Not only does independence forfend us from bad outcomes, independence also must mean independence to do as autocratically as the Fed likes -- or rather, as Wall Street likes. What with economy-wide wage spirals and the like looming in the prudent bizzman's calculating mind -- no Argentina here -- por favor!

The Fed under its normal modus operandi lets our private banks gather in the windfalls of credit expansion, by costlessly creating a larger monetary base and leaving the lending out of the new money -- and at multiples, yet, limited only by a generous reserve ratio -- to the banksta caste. With nice assured margins, too.

The bankstas can lend it out to whomever they wish, and more importantly, not lend it out when they don't wish. And that's what the present so-called liquidity trap really is all about: not lending -- except back to Uncle of course.

Thus arises the "lending vacuum" mentioned above by the Times, that got the Fed pro-tem in the loan biz. And damned if now -- as the horror appears to recede -- these bankers don't get their front men out cautioning Uncle to keep his issuing of new fiscally driven debt -- at least for real purchases of real products -- to a biblical minimum.

Quite the paradox, at least on the surface. After all, the more new securities issued by Uncle, the higher the rate of interest he pays and borrowers earn -- all else equal, as they say.

Here's the great "concern" in a nutshell:

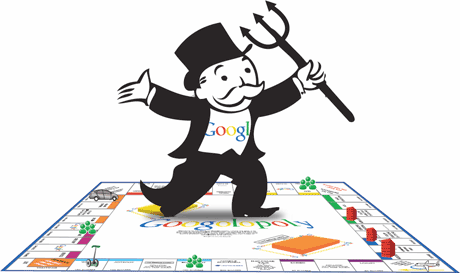

"Executives and lobbyists [will] flock to the Fed, providing elaborate presentations on why their niche industry should be eligible for Fed financing or easier lending terms."Images resembling Griffiths' Reconstruction South Carolina legislature should roll past the inner eye here, in whiteface of course. It is to shudder, comparing this scene of chicken bones and smoldering billion-dollar niche loans piling up on The Hill with that halcyon Babbitland scene of yore where these same "executives" -- with their CFO in tow -- enter the office of the local banker. In the latter scenario, the CEO must fill this beady-eyed banker's ear, not the ear of some ballot-box baboon

Obviously this will lead to a better, higher overall social welfare result. Obviously.

Such are the rhumba-like miracles of "rigorous economic analysis" when clutched tightly in the profit nuts by the grand old goosing hand of the market place.

Comments (7)

Think Baseball Commissioner, Owen. Sturdily independent, capable of occasional public statements, above individual teams, cities, tv contracts and unions, but selected by team owners.

Posted by hce | June 19, 2009 4:21 PM

Posted on June 19, 2009 16:21

But look at the attire -- the tie, the cufflinks, the watch, the wedding band. If there were such a thing as an independent fed chief, you'd want him to look like this. Positively Rooseveltian!

Posted by hce | June 19, 2009 4:25 PM

Posted on June 19, 2009 16:25

The fed as the bankers bank

Has its limitations

One use to be

Bank Reserves

Held by the fed paid no interest now they do

The crisis last fall allowed this like that other september crisis allowed the patriot act to shoot thru from

Dream to reality

Btw folks wonder how the fed could soak back up this vast amount of fresh money

If banks actually chose to lend it out some day in a sudden spring freshet that brought on a towwering inflation burn

Well now the fed could simply pay the banks a high enough interest rate to leave

Make it more profitable to

Leave it be in fed reserves

The fed can always lure as much money out of the system as it once that way

Of course if the time came when the dollar fell off the table in forex markets it my be because allthese free reserves were racing to turn themselves into ..

Yen? Rmb ? Swiss francs ? Rubles?

Florins ?

Pieces of eight ?

Posted by op | June 19, 2009 4:44 PM

Posted on June 19, 2009 16:44

I'm commenting from my phone

Which adds dramatic editorial

Obstacles to the process

I can't paste in shit and I can't

Format my lowkoo

Line brakes

And words seem to appear in the final product I thought I'd expunged

I feel like the blinded poliphemus

Groping his sheep

For them tasteee

Greek rascals

Posted by op | June 19, 2009 5:09 PM

Posted on June 19, 2009 17:09

"...over the creditworthiness of narrow-bore industries like motor homes,rental cars, snowmobiles, recreational boats and farm equipment."

Ok, the last one, farm equipment....wasn't this historically tied into balloon mortgages ...back when grain was king...which would be the model for how recreation equipment would be consolidated into home equity today, who wouldn't refi we all got another 10, 15 years or so left? Narrow-bore? It's an add on for slippery mortgage brokers and bankers no doubt, but why care now? It's all junk, obviously Smiff's boat don't count that's maritime magic like the bounty of red neck new england opinions sailing into bay states ports enable it to gather for our recreation...I hope it's a business expense too, past that ain't all that shit considered as future land fill stomache contents? The only one with the potential for profit is Farm equipment, everything else is a credit card line item. How does that fit- talk to me Opee one?

Posted by Son of Uncle Sam | June 19, 2009 5:42 PM

Posted on June 19, 2009 17:42

Antique farm equipment was strictly cash and carry

Posted by op | June 19, 2009 7:32 PM

Posted on June 19, 2009 19:32

maybe Peas of eight but I'm hoping for a rememberance of V.Balboa's

Posted by Son of Uncle Sam | June 19, 2009 8:15 PM

Posted on June 19, 2009 20:15