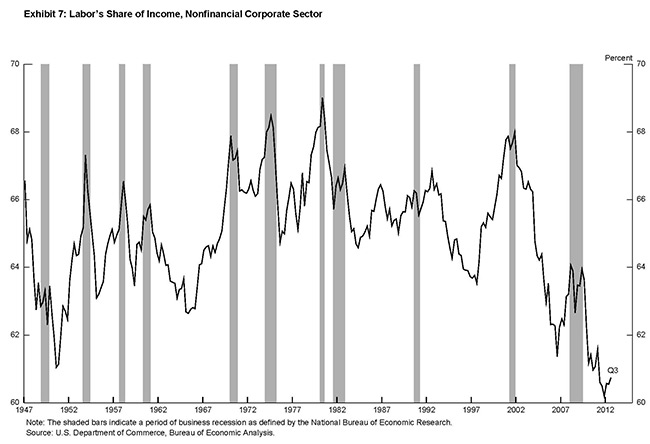

So all you economists out there, tell me why this doesn’t show what I think it does: whenever labor’s share of income rises a bit, they hold a recession. Which takes care of that problem quite nicely.

4 thoughts on “Riddle me this, Batman”

Leave a Reply

You must be logged in to post a comment.

I can’t tell how serious you are, but just in case, I see three potential objections. The first is that there’s no way to show causation from this graph: clearly recessions knock down labor’s share of welath, but you can’t see from a graph that recessions are staged to this end. The second would be a general political one: “no one wants a recession; all recessions show is that the economy is too complicated to really control.” The third would be that in ’49, ’90, and ’08, it really doesn’t look like labor needed kicking; I guess you could argue those recessions were freebies.

You’re right, of course: correlation doesn’t show causation, much less intent. But it’s kinda thought-provoking, innit?

– steep decline in rate of profit beginning 1969-71

– capital into ‘attack mode’ v worker’s wages which, btw, peaked in -1972

– why?> attempt to reduce drop in profit rate but no real success until mid-80s [and

even then more of a stabilization than recovery of higher earlier rate]

– transform in mode of organization, rise of real transnat enterprises and partnering w/bank capital – iow, greater cap merger and mobility. ”see y’all, we’re moving to…” And, ”adios guys, the robotics are coming in” And, And, ‘lockdown the shiutters’, And, And, And

– Carter signs off an ‘Wall Streets guy’, Volker — gotta save institutional bond firms which also meant ‘kill inflation’, no doubt you recall those rate hikes

– deeper double slump than what would have been

– this also a transitioning to progressively greater ‘financialization’

– And, being tired, I’ll just add this bit from Patrick Bond:

”… as profit rates fall in the productive sectors of an economy, capitalists begin to shift their investable funds out of reinvestment in plant, equipment and labour power, and instead seek refuge in financial assets. To fulfil their new role as not only store of value but as investment outlet for overaccumulated capital, those financial assets must be increasingly capable of generating their own self-expansion, and also be protected (at least temporarily) against devaluation in the form of both financial crashes and inflation. Such emerging needs mean that financiers, who are after all competing against other profit-seeking capitalists for resources, induce a shift in the function of finance away from merely accommodating the circulation of capital through production, and increasingly towards both speculative and control functions. The speculative function attracts further flows of productive capital, and the control function expands to ensure the protection and the reproduction of financial markets. Where inflation may be a threat, the control functions of finance often result in high real interest rates and a reduction in the value of labour- power (and hence lower effective demand).”

‘CONTROL FUNCTIONS EXPAND’, until…..

Hope you get the picture, think distribution/redistribution ad ….

and a few more charts.

.http://www.motherjones.com/politics/2011/02/income-inequality-in-america-chart-graph

Yeah, it’s negative for capital but we have an idiot ruling class

But that is exactly what economists say about post WWII recessions. Inflationary pressures pick up as the economy hits capacity and the Fed hits the brakes.

The fluctuations are the dual mandate of the Fed. The step change is of course policy change.