A recent forecast:

"The U.S. is in the midst of another “jobless recovery” ....employment gains

have been meager relative to enormous job losses that occurred during 2008 and

2009. We anticipate that job gains will continue at a moderate rate... the

pre-recession peak in private nonfarm payroll employment won’t be reached until

2013, nearly 4 years after the recession ended....approximately four times as l

after the recessions in 1970, 1973–75, and 1981–82."

How long, oh Lord? How long? About 2-1/2 more years, sez this outfit;

that is, 2-1/2 years before the economy is employing as many jobbler souls as at

the peak of the prior cycle, the poker-chip flat Baby Bush recovery.

Now embedded in that prediction, is a very interesting expectation: next year,

according to this "well respected" tanker model, we will reverse the recent slow

net job formation.

How much of a diff in rates are we talking here?

Well, let's say we finish this year up a million private sector jobs from the

trough of '09. Next year these Merlins expect the private sector to generate

about 2.7 million net new jobs, i.e. a pace two and a half times faster than

this year.

Here's the oddly disquieting rub, however: first we'll slow down even more!

Yup, the forecasted pace for the rest of this year is a dramatic slowdown --

seasonally adjusted -- from the pace of the first 9 months of the year,

from about 100 thousand new jobs a month to 30 thousand.

But then supposedly we're to expect a a jump up to over 200 thousand

net new jobs per month next year.

Where in hell is this surge expected to come from? We can count out the

obvious policy impactable sources -- gub, Fed, and trade. So how?

Spontaneous household spending binge? A sudden revival of house building?

Or maybe a surge of.office building, plant building, commercial building...

In other words, an apparently completely unmotivated acceleration of new

facilities investment by corporate America and landlord America.

Sound likely to you? Well, it's all a matter of millions of interacting

agencies, so in truth who the fuck knows.

These models we get oracular predictions from are like talking parrots;

they have no comprehension of what they are saying. The models mimic the

motions of the economy in a purely mechanical fashion. They

attempt to foresee the future based on extrapolations of equations

derived from past patterns -- mostly recent patterns, by the way.

They're like weather forecasts before attempts at actual physical modeling

were pioneered in the 50's, largely thanks to computers. It's all

closer to the Farmer's Almanac than we ought to feel comfortable about.

Guys who run these operations of course use "hand variables" to add a certain

slant of plausibility into the raw outputs, and of course they are constantly

jiggering their parameters, regearing on the run, to better mimic what history

has recently revealed to be her latest style of locomotion, but as Rudy Dornbush,

a great old reactionary econ-con, used to say, "These fuckers work fine...

till something new and important happens."

Maybe something new and important has just happened, eh?

All indications are clear on one point: overt interventionist macro policy

worldwide or at least throughout the advanced half of the world,

is uniformly inadequate, as much by design as by blind pigheadedness -- much

like parallel policies during the third act of the great depression of the 30's.

Yes, the grim outcomes of the period '37 through '39 may have an echo in the next

few years.

These model forecasts, grim reading as they seem, are actually meant -- believe it or not --

to put a rosy hue on the prospects.

Agitprop requirements, as any SMBIVAer knows, makes these scientific estimations

of tommorrow and tommorrow and tomorrow plain and simply irrelevent, especially if,

as I suspect we really really aren't in the gimcrack Kansas of Ronnie Reagan anymore.

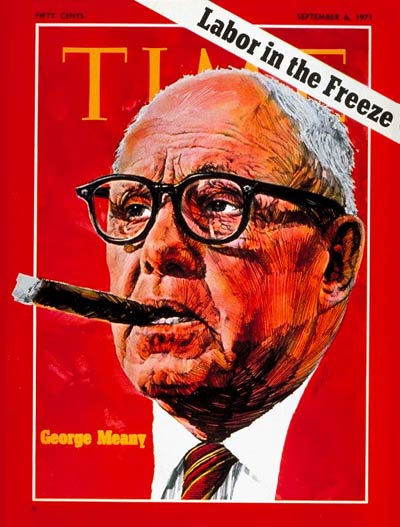

Old warhorse Bob Gordon, sachem of the all-too-numerous Gordon clan of

academical economists(*), has reached forecasting conclusions tinctured

with a protracted gloom even beyond the fondest fantasy of our claque of

poison-pond pwogs.

Old warhorse Bob Gordon, sachem of the all-too-numerous Gordon clan of

academical economists(*), has reached forecasting conclusions tinctured

with a protracted gloom even beyond the fondest fantasy of our claque of

poison-pond pwogs.

"No to reform!"

"No to reform!"

This could have, maybe more properly should have, been a comment caged

This could have, maybe more properly should have, been a comment caged