Noticing the Hellenic crisis allows me to whack a particularly fatuous instance of the perennial debt-bombing siren-sounders -- in this case the paleolithic Brit hysteric Nellie Ferguson, shown above doing an imitation of Tony Soprano doing an imitation of Nosferatu.

Here's Nellie sounding the general all-points alarm:

"It began in Athens. It is spreading to Lisbon and Madrid. But it would be a grave mistake to assume that the sovereign debt crisis that is unfolding will remain confined to the weaker eurozone economies... it is a fiscal crisis of the western world."

"The Obama administration’s new budget blithely assumes real GDP growth of 3.6 per cent over the next five years, with inflation averaging 1.4 per cent. But with rising real rates, growth might well be lower. Under those circumstances, interest payments could soar as a share of federal revenue – from a tenth to a fifth to a quarter."

Imagine! a quarter of the federal budget, interest payments! But, err, to whom will Uncle pay this? Apparently not China:

"The Chinese have sharply reduced their purchases of Treasuries from around 47 per cent of new issuance in 2006 to 20 per cent in 2008 to an estimated 5 per cent last year."

Yikes! At that closing speed, can near-zero great-Han participation in new Uncle issues be far off? And from there, what time till the politburo, by not rolling over their holdings, goes effectively out of the dollar? It might be particularly fast 'cause them damn heathens have bought short, mostly.

Nellie -- always the empire man -- has a nice quote on this very point from no less than Larry S, the Calydonian boar hizseff:

“How long can the world’s biggest borrower remain the world’s biggest power?”

There's one problem with hauling that juicy quote in here: Larry means borrowing from foreigners, like China of course; and as much as Nellie might want to place Uncle in an extravagent inescapable squeeze play, Uncle just plum ain't there. Fiscal deficits are a free lunch these days. Why if more and more deficits is what's called for -- why then, far from an inevitable rundown and tag-out, uncle can keep piling up deficit after deficit even as the foreign holders of Uncle's debt contract their holdings as much as they please. If that starts to happen and if it looks to be affecting interest rates and crowding out productive domestic investments... well the fed can just buy up the deficits all by itself.

And furthermore -- if indeed the foreigners stop buying our public debt issues, you can expect the dollar to tumble, and like the 7th cavalry riding to the rescue, a lower dollar will cause our trade deficit to evaporate automatically, and just as automatically reduce the necessary size of any full-employment federal deficits!

We citizen chumps really need to see all this as clearly as possible, 'cause the phonus balonus keeps on gettin pitched right at us. Here's another example from hissy boy Nelly:

"The long-run projections of the Congressional Budget Office suggest that the US will never again run a balanced budget. That’s right, never. "

Yeah, okay, Nellie... and so what?

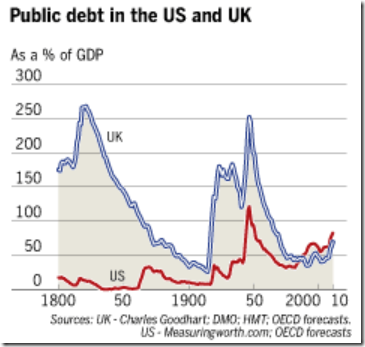

If you want to play this game, here's the key ratio: the long-run ratio of debt to GDP == (deficit /gdp) x (gdp/gdp growth ) => debt growth /gdp growth.

First choose a long-run average rate of deficit as percent of gdp, i.e. the forever-after average fiscal deficit rate. We're at 10-12% or so now, in the depths of a recession; but what is the likely upper bound average deficit forever? That number -- whatever it is -- plus the assumed average rate of gdp growth -- both let us say in current ie nominal not constant dollars -- is anyone's guess, but I'll use a highball set of numbers just to prove my point.

Say we have an 8% average forever deficit to gdp ratio -- the euro zone, that bastion of hard money, seriously disapproves long run average fiscal deficits above 3%. But I'm being a wild man here. And say we have a a modest 5% average forever gdp growth rate -- maybe 2.5% inflation, 2.5% real growth. Then the final ratio of debt to gdp will be as 8 is to 5, right? it's that simple: the debt total will be 1.6 times the current gdp, about twice what it is today here, but very near several Euros and below Japan's.

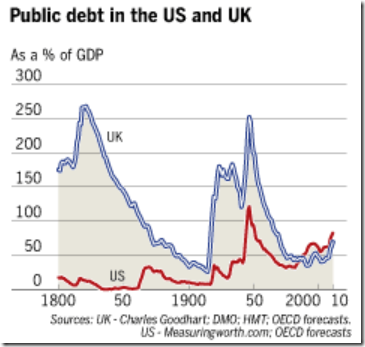

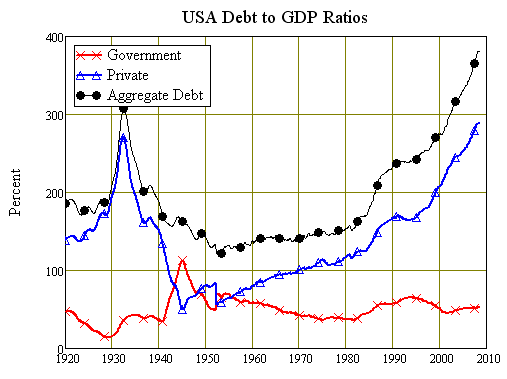

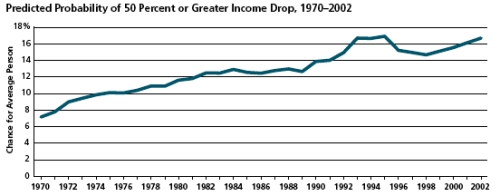

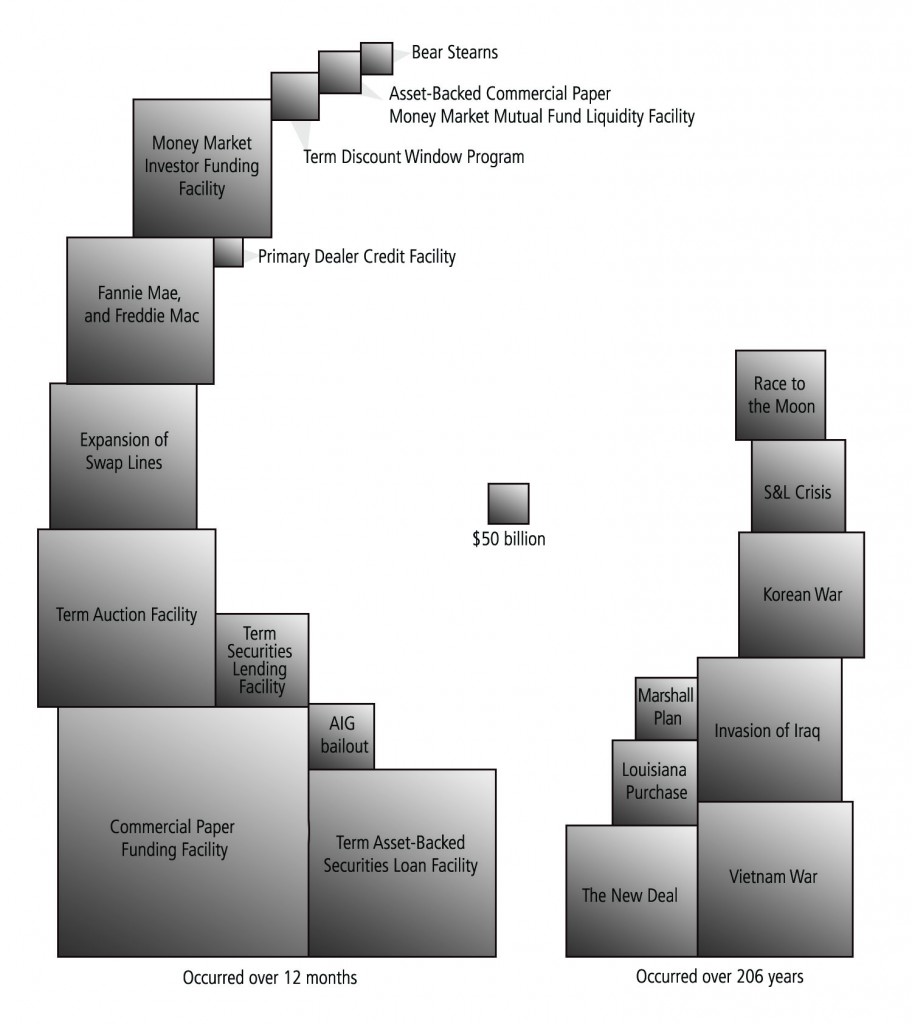

Since Father Smiff can't understand anything numerical without a graph, here are some pictures for his benefit:

So what is the assumed long interest rate (R) paid on the public debt? Multiply whatever rate you choose by the debt to gdp ratio and you have the debt service steady-state "burden" on the economy. In our example, 8(R)/5. If R is a fairly high-side reasonable 6% we get an 9.6% of gdp burden.

If the federal tax take keeps to its present 19% of gdp, servicing the debt will take about half the tax collections; but with another 8% of gdp each year coming into the federal budget, debt servicing becomes 36% of it. Now yes, Aunt Polly, that's a big number indeed. But it's forever, right? So we have plenty of time to find a unique tax base to extract these service payments from.

Say we effectively tax only the wealthy few for this 8% of GDP. If they own half the wealth and wealth is 4 times GDP, then big deal -- an average 4% wealth tax equivalent on the holders of the top half of our national wealth. Sounds like fun to me!

All this was well understood 65 years ago, at least, and these numbers I've used are not way-off estimates of the possibles for the next 30 years.

And remember, my fellow radical imps, we haven't yet used the fiscal monetary "nuclear option": a transition to all public debt held if necessary by the Fed itself; or another non-nuke WMD, namely Uncle's monetary agents running a faster long-term inflation rate while holding the nominal rate of Fed notes at that same target rate, effectively zeroing out the real rate of riskless return.

Poof! Inflation taxing away the public burden of the debt incubus! Yes, the inflation tax, bane of the goldbugs, that invisible built-in adjuster called the changing cost of "living". Not so much fun, that, as taxing the plutonians, but easily adjusted to, once you real producers of real stuff are made aware of the gig.

* * * * *

Now comes Simon Johnson, respected, credentialed, tenured, and once highly-placed global hi-fi technocrat, suddenly turned rogue lion in the street, who's been roaring "cut the big boys down to size" -- and coming from his desk, that has some purchase, as they say. But on today's topic, where does he stand?

Unfortunately, he's as orthodox a poison peddler as Fred Thompson. No free-lunch deficit guy he... not like your pal Owen here.

"No country can go on issuing... debt without consequence", simple Simon says. Ugh, how banal, what typical high-perch crapola.

"The macro situation remains stable only as long as foreigners buy and hold... government debt.... This is a major economic and national security risk.... Unsustainable debt dynamics can undermine us all."

Horsefeathers never were piled any higher than that, and it's all based on the slipped-in assumption that deficits are not sustainable. That assumption, as we've just seen, is pure voodoo hoodoo, once you fling off the sober taken-for-granted unexamined constraints like sacrosanct personal wealth holdings and higher than rock-bottom inflation rates. (You can go down the litany of bourgeois sancta-sanctorum at your leisure.)

Once you can adjust your currency or your inflation rate or your tax targets freely and democrataciously, it's child's play... which brings us back to the playpen du jour, the Hellenic contretemps and the deathly grip of the euro.

One fact spells doom here: Greece has no currency of its own to adjust, so it and Spain and Portugal and my dear Ireland, since they're all similarly shackled, must adjust their price and wage levels instead. Translation: a protracted interval of joblessness, dearth, and misery, so long as the all-powerful "reformed Reichs" to the north of the zone refuse to step up their own rates of price level change.

Just goes to prove... a world without Uncle would find plenty of vicious corporate pricks left on the planet ready able and wildly willing to play sadistic global Procrustes. Andrew Mellon lives and his name is Trichet:

Paul Krugman has been on this beat for a while now:

http://krugman.blogs.nytimes.com/2010/02/11/greek-troubles-are-more-than-fiscal/

http://krugman.blogs.nytimes.com/2010/02/10/riga-mortis/

http://krugman.blogs.nytimes.com/2010/02/07/know-your-deficits/

I've always had a soft spot

for at least

one Kennedy: Ted.

Among many charms,

he's none of his brothers' keeper.

I've always had a soft spot

for at least

one Kennedy: Ted.

Among many charms,

he's none of his brothers' keeper.

According to the

According to the

Just read this charming spirit's

Just read this charming spirit's

At left, our boy, tall Paul, the master of the pythonic credit hold,

right there in a group shot of hi-fi regulators taken not too long ago.

He's the big one in the middle, next to Alan of Green Bubbles.

At left, our boy, tall Paul, the master of the pythonic credit hold,

right there in a group shot of hi-fi regulators taken not too long ago.

He's the big one in the middle, next to Alan of Green Bubbles.

Deepsighted as usual,

Father Smiff dubbed him Fafner, the giant co-builder of Valhalla,

and eventual dragonic keeper of the golden Ring.

Indeed

Volcker's tale has a Wagnerian similitude to it --

not like that long-measure, open-measure, Rhine-flows-on theme

at the beginning of Das Rheingold. More like the the ring of ten thousand sledges or whatever it is in this case(*), blamming away at industrial America, hammering it into a million shivers --

but I digress.

My real point is quite anti-Wagnerian.

Deepsighted as usual,

Father Smiff dubbed him Fafner, the giant co-builder of Valhalla,

and eventual dragonic keeper of the golden Ring.

Indeed

Volcker's tale has a Wagnerian similitude to it --

not like that long-measure, open-measure, Rhine-flows-on theme

at the beginning of Das Rheingold. More like the the ring of ten thousand sledges or whatever it is in this case(*), blamming away at industrial America, hammering it into a million shivers --

but I digress.

My real point is quite anti-Wagnerian.

We at the time

had a shrewd dwarf, Abba Lerner, shown left, with a very big and complete answer

to our inflation rampage. If Jimmy had only listened to him,

instead of allowing that jumbo Princetonian dolt to crush

the dynamo out the then spiraling wage/profit race up the price pole,

and slam it the age-old way -- with a hard-money credit constriction

so tight it knocked the pips out of tumbling dice in Las Vegas

and brought on, with the inevitablity of a Teutonic curse,

by the intricate concatenation of its own internal workings,

the doom of American manufacturing.

We at the time

had a shrewd dwarf, Abba Lerner, shown left, with a very big and complete answer

to our inflation rampage. If Jimmy had only listened to him,

instead of allowing that jumbo Princetonian dolt to crush

the dynamo out the then spiraling wage/profit race up the price pole,

and slam it the age-old way -- with a hard-money credit constriction

so tight it knocked the pips out of tumbling dice in Las Vegas

and brought on, with the inevitablity of a Teutonic curse,

by the intricate concatenation of its own internal workings,

the doom of American manufacturing.

Question for the fair-minded, the nuanced and the shrewdly prudently, inclusive --

is the bright beaverish imp at left (now somewhat grayer, alas)

nothing but a "corporate liberal" bag man?

Question for the fair-minded, the nuanced and the shrewdly prudently, inclusive --

is the bright beaverish imp at left (now somewhat grayer, alas)

nothing but a "corporate liberal" bag man?

Here's the junior senator from Illinois speaking in Pittsburgh a few days back:

Here's the junior senator from Illinois speaking in Pittsburgh a few days back:

His l

His l

By the looks of him alone, I ask you,

ladies and gentlemen of the jury,

how could the likes of this this, this... think-tank porcupine

ever hope to bust apart the trans nat-OITP(*) ring's

all-in, full-tilt, take-no-prisoners attack, which is

even now preparing to apply

ten thousand wrecking balls to whatever still remains standing amidst the rubble of our national industrial platform?

By the looks of him alone, I ask you,

ladies and gentlemen of the jury,

how could the likes of this this, this... think-tank porcupine

ever hope to bust apart the trans nat-OITP(*) ring's

all-in, full-tilt, take-no-prisoners attack, which is

even now preparing to apply

ten thousand wrecking balls to whatever still remains standing amidst the rubble of our national industrial platform?

Here's Brad 'Pugsley' Delong

Here's Brad 'Pugsley' Delong

This is in fact

the lesson out of Japan --

go full-throttle on all fronts,

or you're in for ten years of damnable dorkdom.

This is in fact

the lesson out of Japan --

go full-throttle on all fronts,

or you're in for ten years of damnable dorkdom.

Seems elements in the Fed's governing body are looking to pre-empt a full recovery.

Seems elements in the Fed's governing body are looking to pre-empt a full recovery.

Apparently you can become a statistic even without being counted.

Apparently you can become a statistic even without being counted.

My man Simon Johnson, he of the

My man Simon Johnson, he of the

![[Image unavailable]](http://www.warchat.org/pictures/korean_war_pow.jpg)